Mandatory central clearing of OTC derivatives, as promoted by the G20 Leaders at the 2009 Pittsburgh Summit, addresses some of the financial stability risks that materialised during the Great Financial Crisis. The concept of a Central Clearing Counterparty (CCP) plays a pivotal role in ensuring the stability and integrity of financial markets.As a critical component of the modern financial infrastructure, CCPs are instrumental in reducing counterparty risk, enhancing market transparency, and fostering confidence among market participants. In recent years, we have seen an enormous increase in clearing volumes and products in the financial industry. But are CCPs as safe as they are claiming to be? And will the pros outweigh the cons? We take a look at these questions and also look into what Basel has to say about CCPs. Are they the master machines they claim to be?

A Central Clearing Counterpart is an intermediary organization that acts as a guarantor in financial transactions, particularly in the derivatives and securities markets. Its primary role is to step between the buyer and seller of a financial instrument, becoming the counterparty to both sides of the trade and thereby eliminating the need for direct counterparty risk between the original parties. This mechanism is known as novation.

CCP’s enforce standardized protocols for trade clearing, settlement, and reporting. They enhance market transparency by providing a centralized platform where trades are processed, reducing complexity and operational costs for market participants.

So, what are the main pros of using a CCP?

- Risk Mitigation: acting as an intermediary and reducing counterparty risk.

- Increased Transparency: transparent platform for clearing/settling and reporting. Enhances market integrity and investor confidence.

- Operational Efficiency: reducing complexity by only having one counterparty.

- Standardization of Processes/Products: trading/clearing and settlement procedures.

- Liquidity: bid ask spreads are smaller with mandatory clearing vs bilateral.

- Default mechanism: CCP have a default mechanism in place and uses fire drills to update it regularly.

- Regulatory compliance: CCP need to adhere to strict regulations to be a Qualified CCP.

- Netting benefits: offsetting trades reduces outstanding amounts and margin requirements and is favorable for solvability and leverage.

Market participants often use clearing brokers to get access to a CCP. The market participant has a client relationship with the clearing member or broker and the collateral for variation margin is passed through to the CCP (individual segregation). Although clearing via a broker seems favorable for the client, complexity with legal documents, set up costs and infrastructure maintenance can be challenging.

The main disadvantage is that the clearing broker mostly defines the collateral (and volume) that is accepted for initial margin requirements. There can be a mismatch and especially in a financial crisis, a clearing broker can unilaterally demand more collateral of the highest grade.

Although CCPs have a lot of positives, there are some concerns and challenges regarding CCPs:

- System Risk: “Too Big to Fail”, concentration of all OTC derivatives risk at just a few large CCP’s. A default could spark a domino effect.

- Cyber security: A successful attack on a CCP could disrupt financial markets and compromise the security of sensitive financial data.

- Ensuring adequate collateral/default fund without risking competitive edge. Competition between CCPs incentivizes them to be as cheap as possible (low initial margin) without losing safety measures.

Since the global financial crisis in 2008 and the mandatory clearing by CCPs of certain products, we haven’t had a comparable crisis. However, like any financial institution, CCPs are not immune to the possibility of default or financial stress. To manage such situations, CCPs employ a mechanism known as the "Waterfall Structure." This structure outlines a systematic approach to handling losses and defaults, prioritizing the protection of the financial system.

What to watch for differences in CCPs

Although CCP is a general term and suggests most CCPs have common features, there are some small differences that can result in additional costs, namely:

- Initial Margin calculations: every CCP has their own model for calculating the IM and this results in different levels of IM, especially in stress conditions.

- Default fund risk weight: the safer the CCP the less the risk weight

- Collateral acceptance: in stressful situations, CCPs can change their collateral acceptance (for example no more Greece bonds during a sovereign crisis).

- Basis risk: the quote for 10-year Swap vs 3 months can differ between CCPs.

- Netting agreements: The more products one can use for netting the less capital/liquidity absorption.

Basis risk is volatile as you can see in the graph below, the difference in spread between Eurex and LCH for different maturities:

As you can see for a 10-year swap the difference is 3.5 bps, for a volume of 10 Mio euros this means a valuation difference (duration 8) of 28.000 euro. The reason behind this is that it is mostly supply/demand driven in payer/receiver swaps at the various CCPs and can be volatile. If you want to discuss this more in depth, we are more than happy to discuss.

As you can see for a 10-year swap the difference is 3.5 bps, for a volume of 10 Mio euros this means a valuation difference (duration 8) of 28.000 euro. The reason behind this is that it is mostly supply/demand driven in payer/receiver swaps at the various CCPs and can be volatile. If you want to discuss this more in depth, we are more than happy to discuss.

Waterfall structure of a CCP

The Waterfall Structure is a risk management framework employed by CCPs to manage potential losses and defaults. It is designed to ensure that losses are absorbed in a structured and orderly manner, with the primary goal of protecting the financial system and market participants. The Waterfall Structure consists of several layers or tiers, each with its own source of funds and priority of claim in the event of a default.

- Margin Requirements. There are two types of margins: Variation Margin and Initial Margin.

The Variation Margin (VM) provides for changes in the market value of a portfolio of trades and is calculated on an intraday basis. The collateral must always be cash in the same currency as the trade. The reason is that there will otherwise be a cheapest to deliver option to one of the trade counterparties.

The Initial margin (IM) is held to cover losses that could arise in the period between the defaulter’s last variation margin payment and the closing/replacing of the trade. The IM is posted when the trade is executed and then adjusted as necessary throughout the life of the trade. The collateral can be cash or non-cash (bonds) depending on the restrictions of the CCP and the interest rates/fees involved.

When a Clearing member defaults, all the trading positions of the defaulting member will be closed out or hedged via an auction with the remaining clearing members. The losses incurred will first be covered by the IM of the defaulted clearing member. - Default Fund of the defaulted clearing member. Each clearing member is obligated to contribute a specific amount to the default fund of the CCP. The default fund contribution is calculated based on a minimum amount and a dynamic component (depending on the exposures) and is in cash. When a counterparty defaults, after the IM and VM are used, the default contribution of the defaulted member will be used to cover losses.

- Skin in the Game CCP. If the clearing member’s resources are insufficient to cover all losses, the CCP’s own contribution to the default waterfall, the so-called “Dedicated Amount” or “Skin in the Game” is applied. The purpose of this layer is to incentivize the CCP to appropriately size the IM and default fund contributions of the clearing members so as to mitigate a competitive race to the bottom or poor risk modelling.

- Default Fund of non-defaulted clearing members: The default fund from the non-defaulting members results in risk sharing. This ensures that clearing members also monitor the CCP and do their due diligence.

- Second Skin in the Game of the CCP: More incentives for sound risk management for a CCP

- Additional Funds of the non-defaulted members. However, this is mostly capped at 2 or 3 times the initial default fund contribution.

- Equity Capital CCP

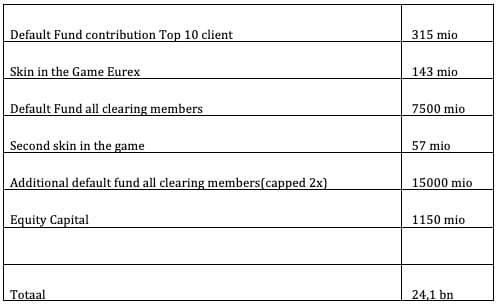

For example, on Eurex, the waterfall structure will result in the following amounts to cover losses:

*August 2023 (https://www.eurex.com/resource/blob/56098/d12e0f057659217884d58a8f68f4991b/data/lines-of-defense.pdf)

*August 2023 (https://www.eurex.com/resource/blob/56098/d12e0f057659217884d58a8f68f4991b/data/lines-of-defense.pdf)

With the default of a clearing member, the trading positions will be hedged and closed. The Initial margin would be used to cover the losses. If this is not sufficient, the default fund of the client approx. 315 Mio would be used and thereafter the 143 Mio of EUREX (skin in the game).

For example, during the Lehman default and the resulting 2008 financial crisis, CCPs had no trouble managing the crisis and no non-defaulted member had to contribute.

Basel

Exposures from cleared transactions attract capital charges under the CCR. Importantly, a CCP has to be a Qualified CCP to obtain the preferential risk weight treatment.

The capital charge is (simplified) calculated as the product of the exposure value and the corresponding RWA (risk weight). The correct calculation depends on fulfilment of the following requirements:

- Non-Recourse. Guarantee from the clearing member.

- Bankruptcy remote. No joint default CM and CCP.

- Segregation. Individual or Net/Gross Omnibus Account.

- Porting. The possibility to transfer your trades to another CCP.

Where a bank acts as a clearing member (CM) of a CCP, any exposure to the CCP from its own/client transactions, or where the bank is obligated to reimburse the client for any losses suffered if the CCP defaults, would attract a risk weight of 2%.

The exposure amount will be calculated using the IMM approach for the banks that have an Internal Model approval for measuring counterparty credit exposure. Banks without that approval will calculate the exposure amount using SA-CCR (instead of CEM as under the interim capital rules), or the Comprehensive

Approach.

A risk weight of 4% would be applicable if the client is not protected against the joint default of CM and any other clients of CM.

The calculation of the capital requirement of the default fund is done in two steps, namely, calculating the hypothetical capital requirement of the CCP and then of the clearing member. The calculation takes into consideration the size and quality of the CCP and the counterparty credit risk exposures of such a CCP. The safer the CCP is, the lower the capital requirement for clearing members. This creates an incentive to avoid a race to the bottom on IM and default fund contributions.

Summary

In conclusion, Central Clearing Counterparties are the unsung heroes of the financial world, working behind the scenes to ensure the stability and integrity of global financial markets. Their role in mitigating counterparty risk, enhancing transparency, and promoting capital efficiency is indispensable. However, they are not immune to challenges, including the concentration of risk, cybersecurity threats, and evolving regulatory landscapes. As financial markets continue to evolve, CCPs must remain vigilant and adaptive, as their effectiveness is crucial to safeguarding financial stability in an ever-changing landscape.

Lees de volledige serie artikelen:

1. BASEL IV: A game changer?

2. Risk-Weighted Assets: Levelling the playing field?

3. Basel IV and Clearing: A clearer picture

4. Basel IV and Securities Financing Transactions (SFT)

5. Cleared Repo: A clearer view on Repos?

6. CCP: Insights of a Master Machine

7. The Euro System Collateral Management System

8. Climate Risk, the facts and the trends

9. How to Risk Manage Climate Risk: Looking for a Crystal ball

10. XVA: X-Value Adjustment